Medicare Advantage: What MedTech Leaders Must Know

Nicole Coustier has over 20 years of experience in U.S. Reimbursement and Market Access and has helped early-stage MedTech achieve widespread reimbursement coverage in the U.S.

If you work in MedTech, you probably spend a lot of time thinking about Medicare, but not always about Medicare Advantage (MA). That’s a missed opportunity.

As of 2024, over 30 million people, more than half of all Medicare beneficiaries, are enrolled in MA plans. In some states, the share is much higher: more than 60% of beneficiaries in Minnesota, Florida, and Hawaii are in MA, and in Puerto Rico, enrollment exceeds 90% of the Medicare population.

For early-stage MedTech companies, understanding how these plans work, and how they make coverage and payment decisions, can be just as important as understanding traditional Medicare policy.

Why Medicare Advantage Matters

Unlike traditional Medicare, which operates under uniform national and local coverage determinations (NCDs and LCDs), MA plans are offered by private insurers who are paid a per-member, per-month rate by CMS. This gives them flexibility to design their own benefits, manage utilization, and negotiate provider contracts.

From a MedTech perspective, that flexibility is a double-edged sword. On one hand, MA plans can move quickly to adopt new technologies if they see clear value for their members and their bottom line. On the other, they can impose prior authorization requirements, step therapy, or other utilization controls even when traditional Medicare covers the same service without restrictions.

How Coverage Really Works

It’s tempting to assume that if traditional Medicare covers your technology, Medicare Advantage plans will automatically follow suit. But the reality is more nuanced.

MA plans are only required to follow traditional Medicare coverage when there is an explicit NCD or LCD in place. If no such determination exists, MA plans can, and often do, default to their commercial medical policy criteria. These may have different evidence requirements, clinical guidelines, or utilization controls than Medicare FFS. This can lead to a patchwork of coverage policies across MA plans, even for technologies commonly used in the Medicare population.

For MedTech innovators, this means a strong FFS coverage position isn’t a guarantee of MA coverage unless it’s codified in an NCD or LCD.

Patient Responsibility: Medicare FFS vs. MA

Out-of-pocket costs can also shape adoption.

Under Medicare Fee-for-Service (FFS) / Original Medicare / Traditional Medicare, patients are generally responsible for 20% coinsurance for Part B services, with no out-of-pocket maximum unless they have supplemental coverage (Medigap).

Under Medicare Advantage, plans set their own cost-sharing structures within CMS limits, and most have an annual out-of-pocket maximum. Kaiser Family Foundation (KFF) data show the average out-of-pocket maximum in 2024 is just under $5,000 for in-network care. While this cap can protect patients from catastrophic costs, MA plans may require higher copays for certain services, influencing whether patients and providers choose to use your technology.

Coding and Payment Differences

MA plans use the same CPT, HCPCS, and ICD-10-CM code sets as Medicare FFS, but payment levels can differ.

Payment Rates: MA plans are not bound to Medicare FFS rates and often negotiate directly with contracted providers. Your technology’s payment may vary widely between plans and even between providers in the same market.

Bundling Rules: Many MA plans follow Medicare’s bundling logic, but some apply commercial-style edits that group services differently.

Alternative Payment Models: MA’s capitated payment structure means your technology may be evaluated for its fit within value-based care arrangements, not just fee-for-service economics.

Working with MA Plans Strategically

Because MA plans balance clinical outcomes with cost management, engaging them requires a targeted approach. Evidence should not only demonstrate safety and effectiveness but also quantify the total cost-of-care impact in their covered population. High-impact use cases—particularly for conditions driving significant spending in older adults, such as heart failure, diabetes, and musculoskeletal disorders—should be front and center.

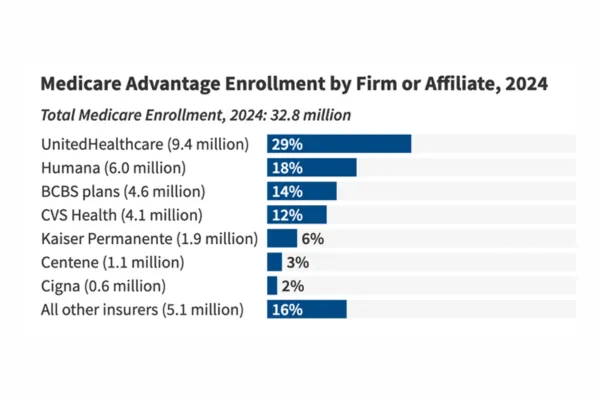

It’s also worth noting that MA enrollment is concentrated among a few insurers. In 2024, UnitedHealthcare and Humana together account for nearly half of all MA enrollment. For a medtech company, this concentration means that building relationships with just a handful of organizations can influence a large share of the market.

Finally, timing matters. MA plans often incorporate coverage and benefit changes during their annual bid cycle. Knowing when and how they evaluate new technologies can help align your outreach with decision windows.

Why This Matters for Early-Stage MedTech

For technologies aimed at Medicare-aged populations, MA is no longer a side consideration—it’s half the market. And because these plans can be more nimble than traditional Medicare, they can become early adopters and champions of innovation. But they can also be selective gatekeepers, requiring tailored engagement, plan-specific evidence strategies, and a business case that aligns with their care management priorities.

In short, Medicare Advantage may be a core part of your technology’s reimbursement landscape. Being informed on MA can be the difference between limited uptake of your tech and broad, sustained adoption.

Do you have U.S. commercialization questions? Schedule an Introductory Call

Whether it's how the multiple payer landscape works in the U.S., how to validate device or procedure coding, timelines associate with product uptake - we're happy to answer them.